How Best Bankruptcy Attorney Tulsa can Save You Time, Stress, and Money.

How Best Bankruptcy Attorney Tulsa can Save You Time, Stress, and Money.

Blog Article

Tulsa Ok Bankruptcy Specialist Can Be Fun For Anyone

Table of ContentsThings about Chapter 7 - Bankruptcy BasicsTulsa Bankruptcy Consultation Things To Know Before You Get ThisThe 7-Second Trick For Tulsa Ok Bankruptcy AttorneyAn Unbiased View of Experienced Bankruptcy Lawyer TulsaThe Basic Principles Of Bankruptcy Attorney Tulsa

The stats for the various other major kind, Phase 13, are even worse for pro se filers. (We break down the differences between both kinds in deepness below.) Suffice it to say, consult with a lawyer or more near you who's experienced with personal bankruptcy regulation. Right here are a couple of resources to discover them: It's understandable that you could be reluctant to pay for a lawyer when you're already under considerable economic pressure.Several attorneys likewise use totally free appointments or email Q&A s. Take advantage of that. Ask them if bankruptcy is undoubtedly the ideal selection for your circumstance and whether they assume you'll certify.

Advertisement Now that you have actually determined personal bankruptcy is undoubtedly the best training course of action and you with any luck removed it with an attorney you'll need to get started on the paperwork. Before you dive right into all the official insolvency types, you must get your own papers in order.

Facts About Tulsa Bankruptcy Consultation Uncovered

Later on down the line, you'll really require to prove that by divulging all kinds of info about your monetary events. Right here's a fundamental checklist of what you'll need when traveling in advance: Identifying documents like your chauffeur's permit and Social Safety and security card Tax obligation returns (as much as the previous four years) Evidence of earnings (pay stubs, W-2s, self-employed profits, income from possessions as well as any type of revenue from federal government benefits) Financial institution statements and/or retirement account statements Evidence of value of your properties, such as lorry and genuine estate assessment.

You'll want to comprehend what kind of debt you're attempting to fix.

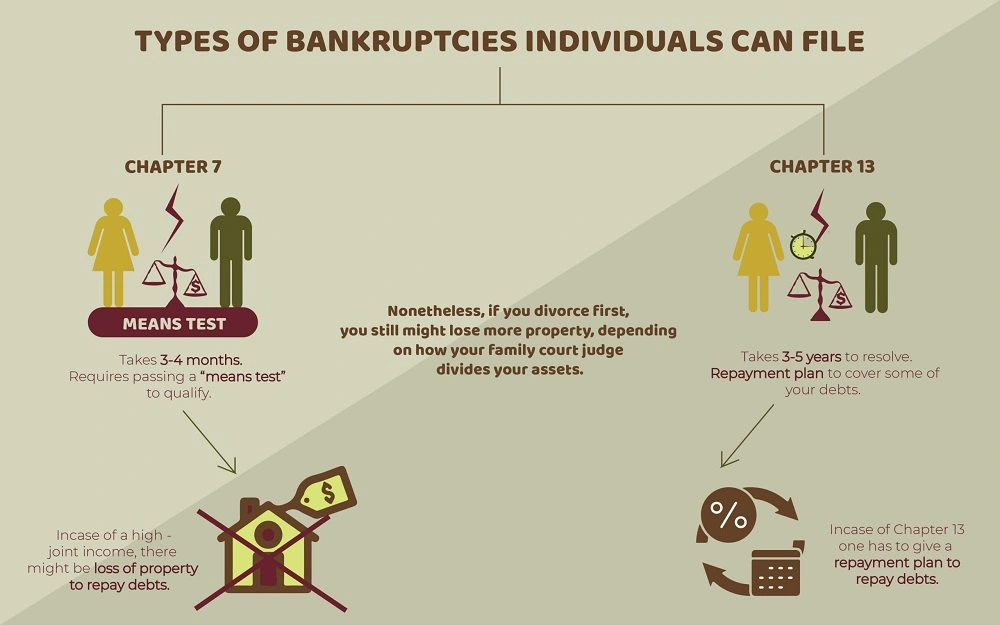

You'll want to comprehend what kind of debt you're attempting to fix.If your revenue is too expensive, you have another alternative: Chapter 13. This alternative takes longer to fix your financial obligations because it calls for a long-lasting payment strategy generally three to 5 years before several of your remaining debts are cleaned away. The filing procedure is also a whole lot much more complicated than Discover More Chapter 7.

Tulsa Debt Relief Attorney Can Be Fun For Everyone

A Chapter 7 bankruptcy stays on your credit score report for 10 years, whereas a Phase 13 insolvency falls off after seven. Before you submit your bankruptcy forms, you must initially complete a mandatory training course from a credit rating therapy firm that has been authorized by the Department of Justice (with the noteworthy exception of filers in Alabama or North Carolina).

The program can be finished online, face to face or over the phone. Programs generally cost between $15 and $50. You have to finish the training course within 180 days of declaring for insolvency (Tulsa bankruptcy lawyer). Make use of the Department of Justice's website to locate a program. If you live in Alabama or North Carolina, you must choose and complete a course from a checklist of individually authorized suppliers in your state.

Tulsa Debt Relief Attorney for Dummies

A lawyer will generally handle this for you. If you're submitting by yourself, recognize that there have to do with 90 various bankruptcy districts. Check that you're filing with the proper one based upon where you live. If your long-term home has actually relocated within 180 days of filling up, you should submit in the district where you lived the greater part of that 180-day duration.

Usually, your personal bankruptcy attorney will work with the trustee, however you might need to send the Tulsa bankruptcy attorney person papers such as pay stubs, tax obligation returns, and financial institution account and credit scores card statements directly. An usual misconception with personal bankruptcy is that as soon as you file, you can quit paying your financial obligations. While bankruptcy can aid you clean out many of your unsafe debts, such as past due clinical costs or individual financings, you'll desire to maintain paying your month-to-month payments for safe financial debts if you want to maintain the home.

Bankruptcy Attorney Tulsa - The Facts

If you're at risk of repossession and have exhausted all various other financial-relief choices, then applying for Chapter 13 may postpone the repossession and conserve your home. Ultimately, you will certainly still require the earnings to continue making future mortgage payments, along with repaying any late settlements over the course of your settlement plan.

If so, you might be needed to give added information. The audit might postpone any kind of financial obligation relief by numerous weeks. Obviously, if the audit shows up wrong information, your situation might be dismissed. All that said, these are rather uncommon instances. That you made it this far while doing so is a good indicator a minimum of several of your financial debts are qualified for discharge.

Report this page